- TOP

- INVESTOR RELATIONS

- To Our Shareholders & Investors

To Our Shareholders & Investors

We would like to express our deepest gratitude to our shareholders and investors for their continued support. We are pleased to report our business results for the fiscal year ended March 31, 2025.

Summary of the 91th fiscal year and future direction

Q1 What kind of year was FUKUVI Chemical in the fiscal year ending March 31, 2025?

During the consolidated fiscal year, the Japanese economy experienced a gradual recovery. This was driven by a rebound in corporate production activities and sustained capital investment, alongside improvements in personal consumption supported by rising wages and increased inbound demand.

However, the economic outlook remains uncertain due to several challenges. These include higher corporate financing costs resulting from policy interest rate hikes, soaring resource prices, persistent inflation, and growing concerns over a global economic slowdown triggered by U.S. tariff policies.

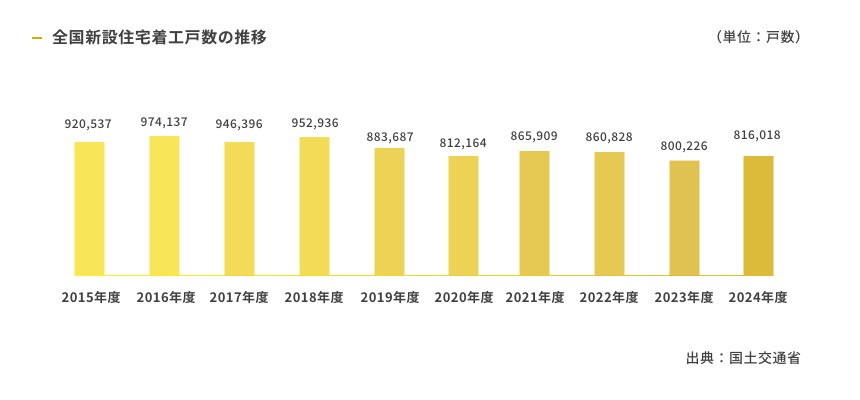

In the housing sector, which is closely tied to our corporate group, the downward trend in owner-occupied and condominium housing persisted. Nevertheless, a surge in last-minute demand was observed in March 2025, ahead of regulatory changes such as the mandatory compliance with energy-efficiency standards beginning in April 2025 and the narrowing of the Category IV exemption. As a result, new housing starts in fiscal 2024 totaled 816,000 units, marking a 2.0% increase year-on-year, with total floor area reaching 62.83 million square meters, up 1.0%.

In contrast, the non-residential construction sector saw a decline, particularly in offices, factories, and warehouses. Consequently, the total floor area of newly initiated private non-residential buildings in the same fiscal year fell to 34.744 million square meters, representing a 10.5% decrease compared to the previous year.

Q2 Please tell us about your mid-term management plan.

Our corporate group has been conducting business activities under the guiding principles of the 7th Medium-Term Management Plan, “Driven by Technology, Excited for the Future” (Fiscal 2023–Fiscal 2027).

• Expansion of Circular Business Models

In our Fandaline outdoor furniture series, we expanded our lineup of environmentally conscious products by launching three new bench models featuring concrete support legs. To promote the effective use of wood resources, we jointly developed Mokuyuka in collaboration with Japan Kenzai Co., Ltd., Miyoshi Sangyo Co., Ltd., and Tottori CLT Co., Ltd., with sales commencing in April 2025.

We will continue to foster inter-company collaboration to accelerate the development of circular business models and contribute to the realization of a sustainable society.

• Establishment of a Robust Revenue Base

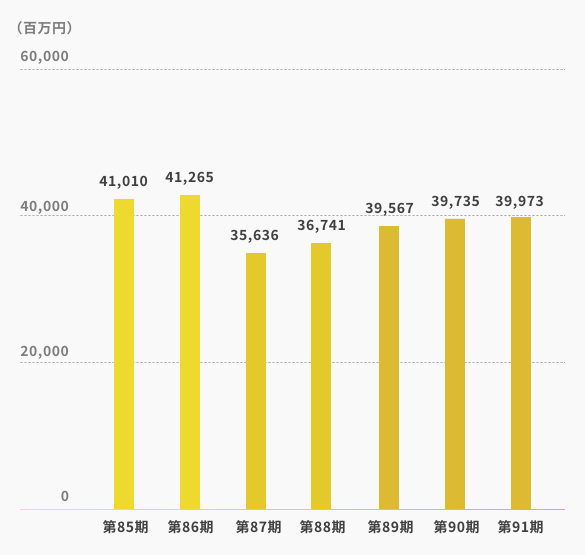

Despite some softness in demand for certain housing material products, our focused efforts in growth areas led to consolidated net sales surpassing those of the previous fiscal year. In parallel, we are optimizing inventory assets to further enhance profitability and strengthen financial stability.

i. Insulation-related products performed strongly, and our continued initiatives in the automotive sector—such as proposing high value- added technologies and engaging in specification-in activities—yielded positive results.

ii. The launch of our new core system improved the accuracy of inventory-related data. Although the revaluation of inventory incurred a temporary expense, it contributed to reinforcing our profitability and laying a stronger financial foundation for the future.

ⅲTo enhance production efficiency, we have continued to refine our work processes. The standardized extrusion molding model line, which commenced operations last year, is now operating smoothly and consistently.

• Building an Organization that Drives Growth

We recognize that strengthening our corporate governance framework is essential to building an organization capable of sustaining growth. Under a new leadership structure led by both the CEO and COO, we have clearly delineated the roles of oversight and execution. To support agile and accurate decision-making, we have delegated authority appropriately and revised internal regulations accordingly.

As part of our efforts to enhance employee engagement, we introduced a restricted stock incentive plan for members of the employee stock ownership association. From a talent management perspective, we are also advancing the development of a comprehensive human resources database. This initiative aims to enable optimal personnel placement and reinforce our organizational capabilities.

Q3 What issues do you need to address going forward?

We are currently navigating a pivotal moment shaped by a complex array of environmental changes—including the ongoing recovery from the 2024 Noto Peninsula Earthquake, structural shifts in the global economy, escalating climate risks, and rapid technological advancements such as generative AI. While these developments pose significant challenges, they also present new avenues for innovation and growth. Our group views this transformative period as a strategic opportunity and remains committed to a management approach that balances the pursuit of a sustainable society with the enhancement of corporate value.

To achieve sustainable growth and strengthen our corporate value, we are prioritizing the following key initiatives:

① Expansion of Businesses Addressing Social Challenges

Under the 7th Medium-Term Management Plan, our group has identified the expansion of circular businesses as a core strategic focus. We are actively strengthening business domains that promote resource efficiency and recycling. These initiatives not only support environmental sustainability but also contribute to solving broader social issues such as climate change and regional revitalization. By leveraging our technological capabilities and industry expertise, we aim to build a resilient business model that harmonizes environmental impact reduction with economic advancement.

② Strategic Utilization of Advanced Technologies and Human Resource Development

We regard advanced technologies—including generative AI—as key differentiators in our management strategy and are actively investing in their adoption and application. In parallel, we are focused on developing and securing talent capable of harnessing these technologies to drive innovation and elevate both the sophistication and efficiency of our operations.

Moreover, we are committed to cultivating a workplace environment that nurtures individual creativity and fosters an inclusive organizational culture that values diversity and respects different perspectives.

③ Strengthening Relationships with Stakeholders

We aim to deepen engagement and collaboration with a broad spectrum of stakeholders. Through transparent information disclosure and constructive dialogue, we seek to build stronger trust and create shared value through co-creation. In our communications with investors, we will clearly articulate a long-term value creation narrative that integrates both financial and non-financial perspectives.

④ Enhancing the Global Management Foundation

In response to the maturing domestic market, we are reinforcing our global management foundation to accelerate growth in international markets. By promoting localization strategies tailored to regional characteristics and optimizing the allocation of management resources across the group, we aim to address social challenges in each region while achieving sustainable growth. Additionally, we are actively developing and appointing global talent to build a management structure that embraces diverse viewpoints and supports our global expansion.

Q4 Finally, do you have a message for shareholders?

In Japan’s housing industry—one of our group’s core markets—rising interest rates are dampening consumer willingness to purcahse homes, while soaring material costs continue to push construction expenses higher. As a result, the number of new housing starts is expected to remain subdued. Compounding these challenges are structural issues within the construction sector, including labor shortages and an aging workforce, making productivity enhancement and technology transfer increasingly urgent management priorities.

Despite these headwinds, our group remains committed to strengthening its product development and proposal capabilities to meet evolving societal needs. These efforts include:

• Advancing decarbonization in housing in line with our goal of achieving carbon neutrality by 2050

• Expanding demand for environmentally friendly homes, such as Net Zero Energy Houses (ZEH)

• Developing housing solutions adapted to new work styles, including remote work

• Promoting resilient housing that can withstand natural disasters

In addition, we are accelerating the transition from a flow-based to a stock-based business model by expanding our renovation and after-sales maintenance services in the existing housing market.

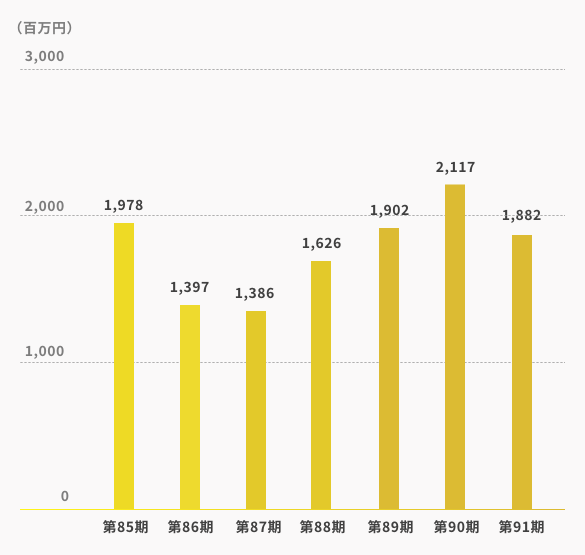

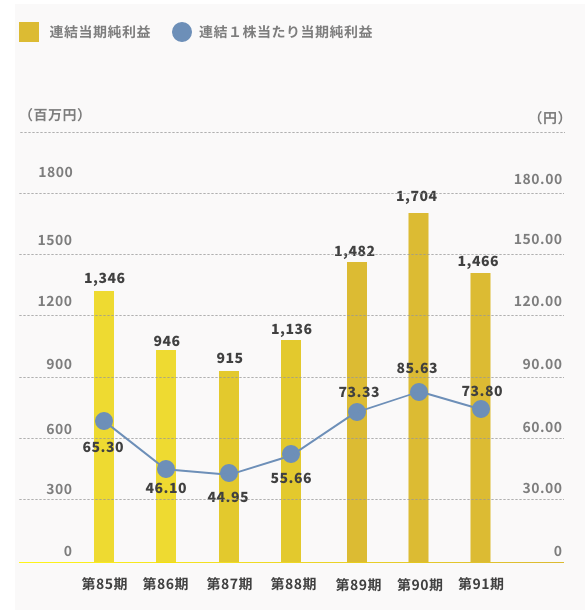

By actively advancing the three core strategies outlined in our 7th Medium-Term Management Plan—“Expansion of Circular Businesses,” “Establishment of a Robust Profit Base,” and “Organizational Development to Support Growth”—we forecast the following consolidated results for the fiscal year ending March 2026:

• Net sales: ¥41.46 billion

• Operating profit: ¥2.12 billion

• Ordinary profit: ¥2.23 billion

• Net profit attributable to owners of the parent: ¥1.56 billion

Looking ahead, we remain firmly committed to the steady execution of our medium- to long-term strategies, with the aim of evolving into a company that continues to meet the expectations of our shareholders. We sincerely appreciate your continued understanding and support.

Financial Highlights

Consolidated Net Sales

Consolidated Ordinary Income

Consolidated Net Income / Consolidated Net Income per Share

Consolidated Total Assets / Consolidated Net Assets

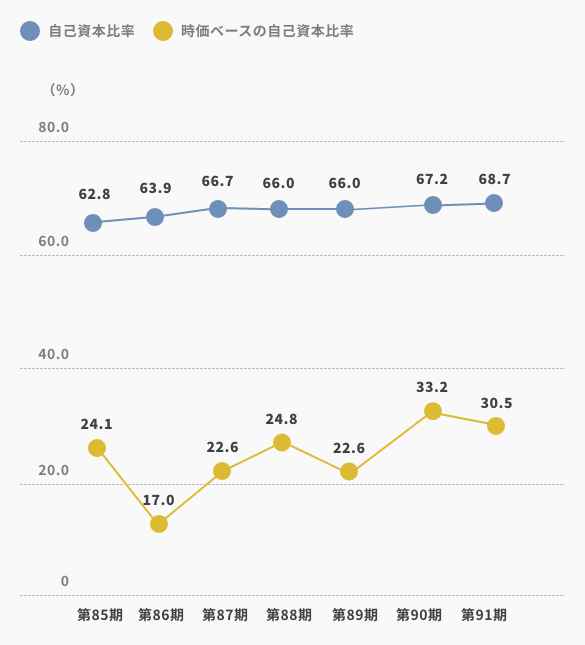

Shareholders' Equity Ratio / Shareholders' Equity Ratio based on Market Value

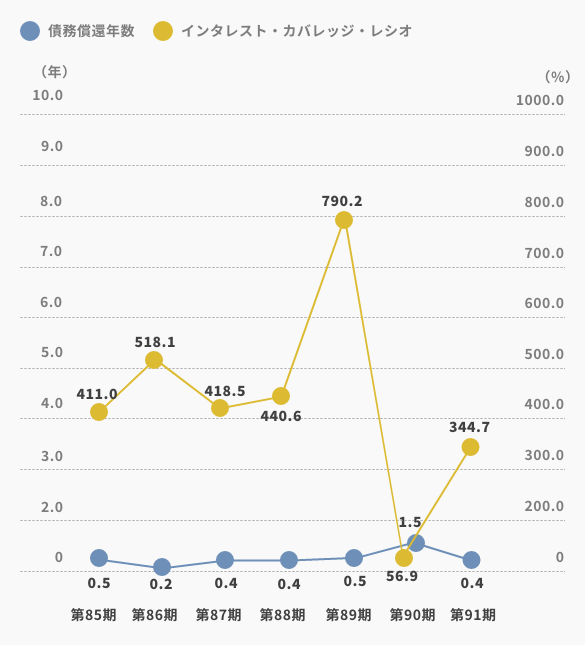

Debt repayment period / Interest coverage ratio

■All calculations are based on consolidated financial figures.

■Market capitalization is calculated by multiplying the closing share price at the end of the fiscal year by the number of shares outstanding at the end of the fiscal year (after deducting the number of treasury stock).

■Cash flow is based on operating cash flow.

■Interest-bearing debt includes all liabilities on the balance sheet for which interest is paid.